From Tax Drag to Capital Clarity: Why Global Investors Are Turning to Middle Eastern Luxury Real Estate

Image courtesy of Starling Properties

A wise investment isn’t measured in square feet—it’s measured by what that space enables.

You invest in properties that perform based on how they fit your life and build your portfolio.

Dubai offers more than luxury real estate. It provides room to grow—financially and personally. A beachfront home with no annual property tax. A purchase process built for clarity, not friction. Ownership without compromise.

I’m Trent Challis, Chairman of Starling Properties. I work with global investors—many from Canada—who come in comparing markets and leave recalibrating their entire strategy. What they find in Dubai isn’t just lower cost. Its scale, simplicity, and liquidity are things that legacy markets no longer offer.

This isn’t about choosing between lifestyle and return. It’s about finding the few places both exist—on your terms.

Let’s start with what your capital actually gets you—and what it doesn’t—on either side of the equation.

What You Can Buy: Scale, Location, Features

Let’s start with the basics.

According to Knight Frank’s data, the top villas in Dubai’s best-known areas—Palm Jumeirah, Emirates Hills, and Jumeirah Bay Island—go for around AED 6,627 per square foot. That’s roughly CAD 2,450. In Toronto or Vancouver, you’re looking at CAD 1,700 to 2,000 per square foot for luxury properties, according to Sotheby’s.

So yes, it looks close on paper. But the outcomes? Not even in the same league.

A USD 5 million home in Dubai can get you a five-bedroom beachfront villa. Think early morning swims in your private pool, coffee on the terrace with skyline views, and a layout built for both comfort and income potential. You’re buying more than walls—you’re buying lifestyle flexibility.

In Toronto? That same amount might get you a three-bedroom condo in a mid-rise building. Shared amenities. Limited privacy. A slower resale window.

I've helped clients secure waterfront penthouses, branded residences, and expansive villas—often for less than a high-end condo back home. It’s not just about more square feet. It’s about more freedom in how you use them.

Taxation: Less Drag, More Retained Value

If you’ve ever looked at your annual property tax bill and thought, “This can’t be sustainable,” you’re not alone.

In Canada, you’re dealing with recurring friction:

- Income tax

- Property tax

- Capital gains tax

The costs nibble away year after year.

According to Deloitte’s UAE Tax Highlights, Dubai’s real estate market benefits from a tax-friendly model:

- No personal income tax

- No capital gains tax on real estate

- No annual property tax

- One-time 4% property registration fee

That’s it—no annual surprises or complex tax layers.

For a CAD 5M property, Canada might hit you with over $60,000 annually in property taxes alone. In Dubai? Your one-time fee—about CAD 200,000—covers it all. And once you’ve paid it, you’re done.

This level of clarity does more than save money. It makes planning easier, especially if you’re managing a cross-border portfolio or thinking long-term.

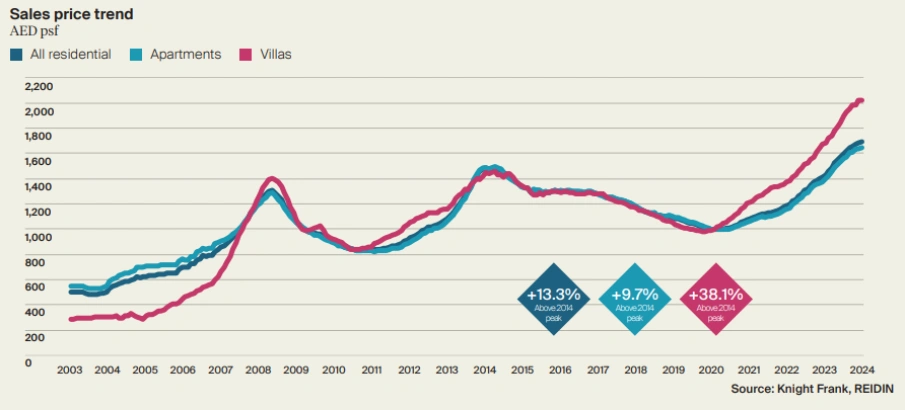

Market Performance: Global Benchmark, Not Outlier

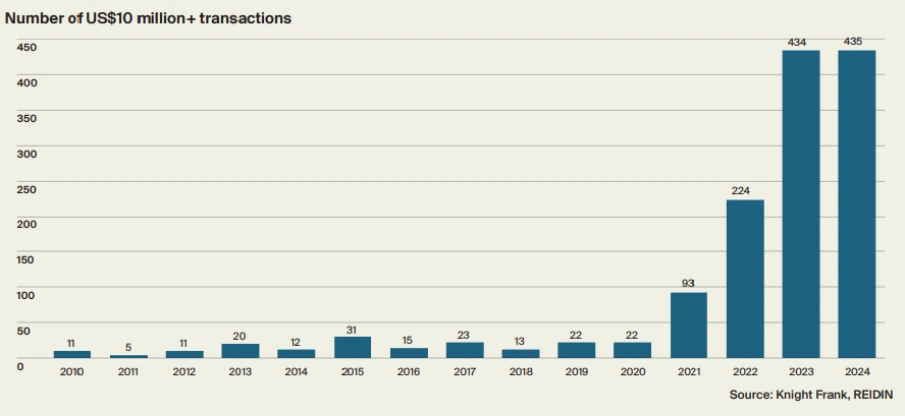

Dubai isn’t just more cost-efficient. It’s outpacing the world in ultra-prime real estate performance.

Knight Frank’s Q4 2024 report shows 435 transactions above USD 10 million in Dubai—more than any other city worldwide. This marks the second year Dubai has led globally in ultra-prime deal volume, surpassing traditional hubs like London, New York, and Hong Kong.

This isn’t a speculative bubble—it’s institutional momentum with staying power. Buyers include ultra-high-net-worth individuals relocating to Dubai, expanding business operations, or optimizing family wealth through asset efficiency. These are strategic acquisitions in a forward-looking economy with robust infrastructure and pro-investor policies.

I’ve seen consistent growth in interest from Canadian investors looking to exit overregulated domestic markets in favor of agile, performance-driven alternatives.

Dubai isn’t a fringe bet—it’s the benchmark.

Ownership in Canada: Hidden Costs and Slowing Momentum

Back in Canada, the environment is heading in the opposite direction.

Sotheby’s State of Luxury Report highlights waning buyer confidence, reduced transaction volumes, and longer days on market in Toronto and Vancouver. Despite high listing prices, properties face sluggish demand and prolonged closings.

Policy constraints contribute to this stagnation. From foreign buyer bans and luxury taxes to evolving lending regulations, investors face more obstacles entering or exiting the market. Liquidity—once Canadian real estate’s core advantage—is fading fast.

We recently worked with a client who owned a luxury penthouse in Vancouver. Despite premium finishes and a desirable location, the property sat on the market for 142 days without a credible offer. Market timing, policy drag, and oversupply in the condo segment played a role.

When acquisition costs climb and demand softens, even well-positioned assets struggle to deliver meaningful returns.

Savills’ Middle East Market Insights states that this growing uncertainty in Canadian markets is pushing investors to look for more agile, performance-driven alternatives, like Dubai. In contrast to Canada’s sluggishness, Dubai is seeing increasing demand and liquidity, where investors are positioning for growth, not hedging their bets.

In that context, Dubai’s liquidity and absorption rates sharply contrast. Investors here aren’t hedging. They’re positioning for growth.

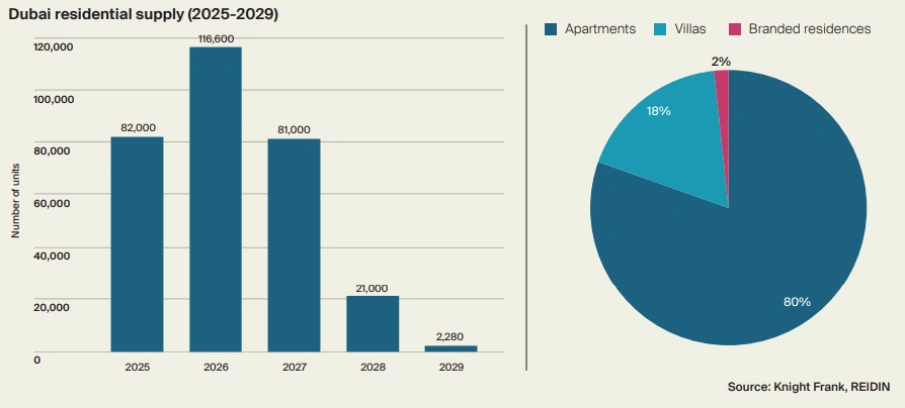

Supply and Scarcity: Controlled Growth = Asset Protection

Investors often fear that rapid growth signals oversupply. However, Dubai’s luxury market has taken a measured, strategic approach.

Knight Frank’s forecast anticipates 302,000 new residential units between 2025 and 2029, of which roughly 80% will be apartments. The supply of luxury villas and branded residences remains tightly limited.

This is deliberate. Scarcity supports long-term appreciation by protecting asset value and signaling enduring demand. For investors acquiring in areas like Palm Jumeirah or Emirates Hills today, it’s not just about entry price. It’s about future defensibility.

A Real Lifestyle Destination, Not Just an Investment Market

Beyond price charts and tax tables, Dubai delivers real-world advantages.

- Elite education

- Global air connectivity

- Premium healthcare

- Safe, high-quality living

As a Golden Visa holder and investor, I’ve seen firsthand how Dubai supports personal and professional growth. It’s a city designed for ambition—one that protects capital, embraces innovation, and welcomes global talent.

Many of our clients at Starling aren’t flipping or speculating—they’re relocating, establishing long-term bases, and structuring future residency strategies around real estate investments.

Lifestyle isn’t a side benefit. It’s a multiplier of long-term value for investors seeking dual-purpose assets.

Dubai Has Already Arrived

Today’s luxury buyers are sharper, more mobile, and laser-focused on performance. They want transparency in ownership, low friction in taxation, and credible long-term growth.

Dubai offers all three.

Compared to Canada’s legacy markets, Dubai presents a compelling blend of affordability, investor-friendly policy, and international lifestyle access. Dubai isn’t emerging—it’s leading the pack.

For investors ready to think globally and act decisively, Dubai isn’t just worth considering—it’s worth prioritizing.

To explore premium Dubai properties with personalized investment guidance, visit trentchallis.com or connect with our team at Starling Properties.

About the Author:

Trent Challis is the Chairman of Starling Properties, a Dubai-based real estate brokerage. He has extensive experience working with global investors and specializes in luxury property investments and tax-efficient ownership strategies.

References:

- Deloitte. (2024). UAE tax highlights 2024. Deloitte. https://www2.deloitte.com/content/dam/Deloitte/global/Documents/Tax/dttl-tax-uaehighlights-2024.pdf

- Knight Frank. (2024). Destination Dubai 2024. Knight Frank. https://content.knightfrank.com/research/2673/documents/en/destination-dubai-2024-11220.pdf

- Knight Frank. (2024). Dubai residential market review Q4 2024. Knight Frank. https://content.knightfrank.com/research/2364/documents/en/dubai-residential-market-review-q4-2024-11992.pdf

- Savills. (2025, January). Middle East Market Insights 2024. Savills. https://www.savills.com/research_articles/255800/371880-0

- Sotheby’s International Realty. (2025, January). Top-tier real estate: 2024 State of luxury annual report. Sotheby’s International Realty. https://sothebysrealty.ca/insightblog/en/2025/01/15/top-tier-real-estate-2024-state-of-luxury-annual-report/

More to Read:

Previous Posts: